trohrs123

is one Smokin' Farker

- Joined

- Sep 10, 2008

- Location

- Oceansid...

Hi

anyone have any recommendations for company that might offer affordable insurance for my new comp trailer?

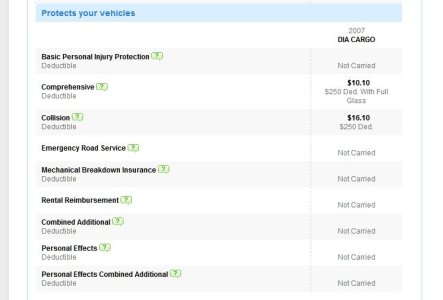

Geico wanted over $8000.00 per year to insure the Honda and trailer under a commercial policy. The commercial policy is the only way for them to insure the trailer,,even though it is used for hobby not commercial purposes.

any help out there?

Tim

anyone have any recommendations for company that might offer affordable insurance for my new comp trailer?

Geico wanted over $8000.00 per year to insure the Honda and trailer under a commercial policy. The commercial policy is the only way for them to insure the trailer,,even though it is used for hobby not commercial purposes.

any help out there?

Tim